sales tax calculator tucson az

Once you have a budget in mind multiply that number times the decimal conversion of the sales tax percentage in your municipality. Name A - Z Sponsored Links.

Arizona Income Tax Calculator Smartasset

For example imagine you are purchasing a vehicle.

. The default sales tax rates are provided for your convienience. Select the Arizona city from the list of cities starting with T below to see its current sales tax rate. The Tucson Arizona sales tax is 860 consisting of 560 Arizona state sales tax and 300 Tucson local sales taxesThe local sales tax consists of a 050 county sales tax and a 250 city sales tax.

70 0065 455. Integrate Vertex seamlessly to the systems you already use. Arizona Income Tax Calculator 2021 If you make 70000 a year living in the region of Arizona USA you will be taxed 10973.

The Vehicle Use Tax Calculator developed and implemented by the Arizona Department of Revenue ADOR is a tool that provides that convenience with a one-stop shop experience. Sales Tax Calculator in Tucson AZ. Before Tax Price Sales Tax Rate After Tax Price Related VAT Calculator What is Sales Tax.

22220 for a 20000 purchase Tucson AZ 111 sales tax in Pima County 21120 for a 20000 purchase Fort Mohave AZ 56 sales tax in Mohave County You can use our Arizona sales tax calculator to determine the applicable sales tax for any location in Arizona by entering the zip code in which the purchase takes place. Multiply price by decimal tax rate. Sales Tax Calculator in Tucson AZ.

Your average tax rate is. Multiply the vehicle price after trade-in andor incentives by the sales tax fee. To calculate the sales tax on your vehicle find the total sales tax fee for the city.

Sales Tax Breakdown Tucson Details Tucson AZ is in Pima County. Tucson in Arizona has a tax rate of 86 for 2022 this includes the Arizona Sales Tax Rate of 56 and Local Sales Tax Rates in Tucson totaling 3. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Arizona local counties cities and special taxation districts.

Please note that special sales tax laws max exist for the sale of cars and vehicles services or other types of transaction. 85701 85702 85703. The Sales Tax Calculator can compute any one of the following given inputs for the remaining two.

Price of Accessories Additions Trade-In Value. The following are the tax rate changes effective February 1 2018 and expiring January 31 2028 Use the State of Arizona Department of Revenues Transaction Privilege Use Tax Rate Look Up opens a new window page to find tax rates by address or map. City of Tucson Notice to Taxpayers Tax Rate Increase Flyer.

Tax Return Preparation Bookkeeping Notaries Public. 1406 S Calle Anasazi Tucson AZ 85735 235000 MLS 22219084 The search is finally over. This fabulous 3 bed 2 bath residence featuring mesmerizin.

Arizona Sales Tax Calculator AZ Rates by County and City ARIZONA STATE COUNTY CITY SALES TAX RATES 2021 This page lists an outline of the sales tax rates in Arizona. Sales Tax Table Arizona AZ Sales Tax Rates by City T The state sales tax rate in Arizona is 5600. Add tax to list price to get total price.

70 455 7455. Arizona has recent rate changes Wed Jan 01 2020. A sales tax is a consumption tax paid to a government on the sale of certain goods and services.

If this rate has been updated locally please contact us and we will update the sales tax rate for Tucson Arizona. Tax Paid Out of State. Tucson is in the following zip codes.

Arizona sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. For more information on vehicle use tax andor how to use the calculator click on the links below. The Tucson Sales Tax is collected by.

With local taxes the total sales tax rate is between 5600 and 11200. Did South Dakota v. These rates were entered mostly from tables published by the ADOR that were effective as of August 1 2015.

Divide tax percentage by 100. This is the total of state county and city sales tax rates. Sales Tax Calculator Calculate Before Tax Amount 000 Sales Tax 000 Plus Tax Amount 000 Minus Tax Amount 000 Enter an amount into the calculator above to find out how what kind of sales tax youll see in Arizona.

Arizona Department of Revenue - Web Page for Sales Tax Rates. You will pay 455 in tax on a 70 item. Download FAQs Download User Guide Go To Calculator.

Please refer to the following links if you are a business owner and need to learn more about obtaining a sales tax permit or making tax-exempt purchases for resale. The Arizona sales tax rate is currently. The sales tax jurisdiction name is Arizona which may refer to a local government division.

Wayfair Inc affect Arizona. 3949 E 29th St Ste 706. The price of the coffee maker is 70 and your state sales tax is 65.

There is no applicable special tax. Tax rates can be verified at the following link. Important Notes - Default Sales Tax Rates.

For example if your budget for your next car is 15000 and you make your purchase in Apache County you would pay about 915 in sales tax 15000 x 061. Find your Arizona combined state and local tax rate. Ad Avalara Returns for Small Business can automate the sales tax filing process.

This will give you the sales tax you should expect to pay. Youll then get results that can help provide you a better idea of what to expect. Tax Return Preparation Tax Return Preparation-Business.

65 100 0065. Start your 60-Day Free Trial plus get 5 Free Filings. List price is 90 and tax percentage is 65.

775 Average Sales Tax Summary. What is the sales tax rate in Tucson Arizona. The sales tax rate for Tucson was updated for the 2020 tax year this is the current sales tax rate we are using in the Tucson Arizona Sales Tax Comparison Calculator for 202223.

Name A - Z Sponsored Links. YEARS IN BUSINESS 520 344-4787. Local tax rates in Arizona range from 0 to 56 making the sales tax range in Arizona 56 to 112.

The December 2020 total local sales tax rate was also 8700. Americas Tax Office of Arizona. Sales tax in Tucson Arizona is currently 86.

Higher sales tax than 70 of Arizona localities 22 lower than the maximum sales tax in AZ The 87 sales tax rate in Tucson consists of 56 Arizona state sales tax 05 Pima County sales tax and 26 Tucson tax. YEARS IN BUSINESS 520 240-7970. The base state sales tax rate in Arizona is 56.

The minimum is 56. 11050 S Nogales Hwy. The Tucson sales tax rate is.

Before-tax price sale tax rate and final or after-tax price. 3 beds 2 baths 1232 sq. Tucson Sales Tax Rates for 2022.

Ad Automate Standardize Taxability on Sales and Purchase Transactions. Tucson AZ Sales Tax Rate The current total local sales tax rate in Tucson AZ is 8700. The minimum combined 2022 sales tax rate for Tucson Arizona is.

The County sales tax rate is. You can find more tax rates and allowances for Tucson.

Property Tax Calculator Casaplorer

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

Arizona Vehicle Sales Tax Fees Calculator Find The Best Car Price

How To Calculate Sales Tax For Your Online Store

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

2021 Arizona Car Sales Tax Calculator Valley Chevy

How To Calculate Cannabis Taxes At Your Dispensary

Arizona Vehicle Sales Tax Fees Calculator Find The Best Car Price

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

How To Charge Sales Tax Vat With Samcart Samcart

Arizona Sales Tax Small Business Guide Truic

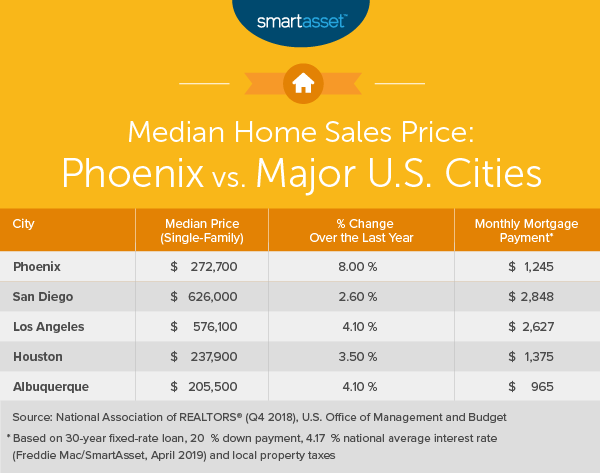

Cost Of Living In Phoenix Smartasset

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

Arizona Sales Tax Guide And Calculator 2022 Taxjar

Arizona Sales Tax Small Business Guide Truic

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation